From Loss-Making Startup to Profitable Fintech Leader

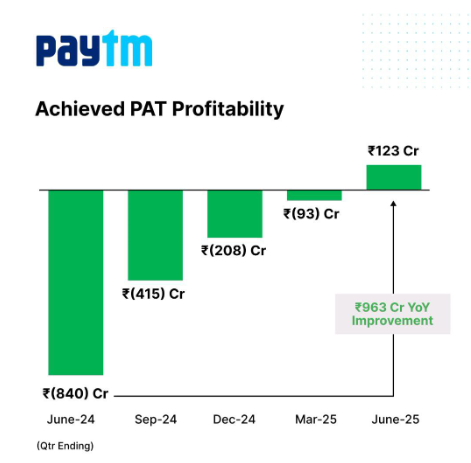

Paytm’s journey from a loss-making startup to a profitable fintech powerhouse has marked a major turning point with its Q1 FY26 results. After years of heavy investment and regulatory hurdles, the company has finally entered a new era of operational and financial maturity.

Key Drivers of Profitability

- AI-led Operational Efficiency: Leveraging AI to reduce manpower and automate processes.

- Cost Optimization: 18% YoY drop in expenses; employee cost fell by 32%, marketing by 50%.

- Strong Lending Growth: Financial services revenue doubled with higher loan disbursals and improved collection.

- Diverse Revenue Mix: Less dependence on cashback models; higher-margin businesses scaling up.

Future Goals & Strategic Outlook:

Maintain Profitability: Sustain EBITDA margin and free cash flow generation.

Maintain Profitability: Sustain EBITDA margin and free cash flow generation. AI Expansion: Expand AI capabilities across customer support, risk analysis, and product delivery.

AI Expansion: Expand AI capabilities across customer support, risk analysis, and product delivery. Financial Services Push: Continue to scale lending and insurance services.

Financial Services Push: Continue to scale lending and insurance services. Merchant Ecosystem: Target 1.5 Cr device deployments by FY26-end.

Merchant Ecosystem: Target 1.5 Cr device deployments by FY26-end. Global Payments Opportunity: Explore new geographies and partner with NBFCs for cross-border and offline payments.

Global Payments Opportunity: Explore new geographies and partner with NBFCs for cross-border and offline payments.

The Road Ahead

The Road Ahead

Paytm’s Q1 FY26 results signal more than just a profitable quarter—they mark the beginning of a new growth cycle for the company. With disciplined financials, tech-driven innovation, and a growing merchant and consumer ecosystem, Paytm is well-positioned to cement its place as a leading digital financial services platform in India.

Stay tuned, because the Paytm story is just getting started.

longterm, #stayinvested #turnaroundstory